Quick Take: ‘Unicorns’ Now Less Rare in China

China last year had a total of 164 so-called unicorns — startups valued at more than $1 billion — with a combined valuation of $628.4 billion, according to a government report.

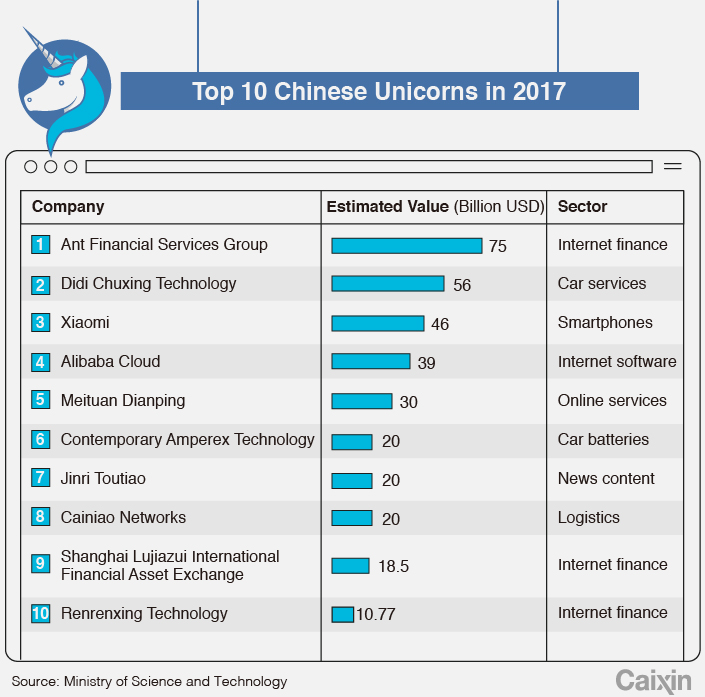

Alibaba affiliate Ant Financial Services Group was the most valuable unicorn, valued at $75 billion, followed by Didi Chuxing Technology Co. and Xiaomi Inc., at $56 billion and $46 billion, respectively, according to a report Friday (link in Chinese) from China’s Ministry of Science and Technology.

Other companies in the top 10 include Alibaba Cloud, the e-commerce giant’s cloud-computing unit; online services platform Meituan-Dianping; electric-car battery-maker Contemporary Amperex Technology; news aggregator Jinri Toutiao; and Alibaba’s Cainiao Logistics.

The ministry report reveals striking growth from previous years. Reports last year cited only 55 Chinese unicorns.

In addition to established sectors like e-commerce, health care, entertainment and logistics, the newer field of online financial services stood out on the list, with two firms in the top 10 — Shanghai Lujiazui International Financial Asset Exchange Co. Ltd. and Renrenxing Technology Co. Ltd. — whose valuations each exceeded $10 billion.

U.S.-based Sequoia Capital has invested in 35 Chinese unicorns, the most active venture capital group on the mainland. Others include IDG capital, Hillhouse Capital, Matrix Partners China and Morningside Venture Capital, which have each invested in at least 10 Chinese unicorns.

The thriving startup ecosystem in China was also supported by the country’s deep-pocket internet behemoths, such as Alibaba Group Holding Ltd. and Tencent Holdings Ltd., which have invested in 29 and 26 of these unicorns, respectively.

Beijing was home to 70 unicorns, followed by Shanghai, Hangzhou, and Shenzhen, with 36, 17 and 14, respectively.

|

Contact reporter Mo Yelin (yelinmo@caixin.com)

- 1PCG Power, Octopus Energy Launch Power Trading Venture in China

- 2Roughly Half of China’s Provinces Miss 2025 Growth Targets

- 3Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas